Japan and India set to benefit from Sino-U.S. tensions but China still leads

Employees of a VC firm in Japan. Government backing of startup initiatives and the pressure on conglomerates to kick-start growth

may see more venture deals emerge. (Photo by Arisa Moriyama)

YIFAN YU, Nikkei staff writer

December 30, 2023 14:09 JST

PALO ALTO, U.S. -- After a painful 2023, Asia can expect a slightly better year for

venture capital investments, but uncertainty and caution will be the watchwords for

investors in 2024.

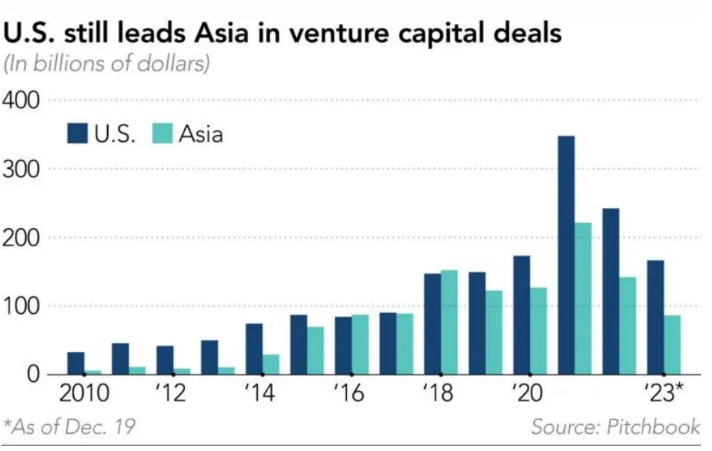

Globally, the past year has been one of the worst in venture investment history, as the

industry grappled with challenges ranging from geopolitical tensions and wars to

economic headwinds and limited exit windows.

Startups in the Asia-Pacific, which have become VC darlings thanks to their rapid

growth and massive markets, attracted 40% less funding from venture investors this

year as of Dec. 19. The total amount raised came to $86.5 billion, down from $141.9

billion in 2022 and just a fraction of $221.4 billion raised in 2021, data from market

research company PitchBook shows.

"[This] has been the year of hanging out, seeing what's happening," said Krish

Ramadurai, a partner at VC firm Harmonix, which focuses on health care and deep

technology. "Cautiously optimistic" will be the theme for 2024, Ramdurai added, as

uncertainties still remain despite expected improvements in the broader economy.

The U.S. remains the biggest VC market, despite a 30% fall in capital raised so far this

year. The figure stood at $166.5 billion as of Dec.19, compared to $242.3 billion for all

of 2022, according to PitchBook.

Anis Uzzaman, founder and CEO of Silicon Valley based Pegasus Tech Ventures, says

American VC funds will have plenty of capital to deploy next year.

"People have a lot of dry powder," Uzzaman said, explaining that many venture

investors and their limited partners -- investors who put money into venture capital

firms -- held off investing in 2023.

But geopolitics and the wars in Ukraine and the Middle East mean a lot of that powder

will be used at home rather than abroad.

"The rebound will be more domestic than international," Uzzaman said. "Wars in

different zones [are] not helping the international investment scenario at all."

This is potentially bad news for Asia, given the huge role U.S. capital plays in the

region's venture capital ecosystem.

"Some investors are taking a wait-and-see approach, taking their time to get more

familiar with emerging markets in Asia, especially due to the highly localized nature of

those markets," said Kyle Stanford, the lead U.S. venture capital analyst at PitchBook.

Domestic politics, namely the 2024 presidential election, are also expected to influence

U.S. investment in Asia next year and beyond.

"The election is definitely going to play a huge role in tech investment in 2024,"

Uzzaman said.

A second term for Democrat Joe Biden would likely mean a more relaxed and strategic

approach to China after a fairly hawkish first term, according to Uzzaman. In August,

for example, Biden signed an executive order that restricts certain American

investments in mainland China, Hong Kong and Macao in high-tech sectors such as

artificial intelligence, semiconductors and quantum technology.

On the other hand, if a Republican is elected, more China-hawk policies are expected as

the new president would be laying the groundwork for a potential second term.

U.S.-China tensions coupled with a slowdown in Asia's biggest economy have led many

foreign venture capital investors to seek opportunities in other markets around the

region.

"Investors have been bullish on Japan and India. Both have various factors in their

favor, but capital movement out of China may be one of the biggest," said Kaidi Gao,

PitchBook's Asia market analyst.

India's growth could catapult the economy into the top 3 globally over the next few

years, while its large population is expected to provide a robust talent pipeline for the

country's startup ecosystem.

In Japan, the government's backing of startup initiatives and the pressure for large

conglomerates to kickstart growth could provide the impetus for more venture deals in

the coming years.

Vietnam is another nation to benefit from the China exit as more companies shift their

supply chains to the Southeast Asian country, Uzzaman said.

However, it is unlikely that any nation in Asia will overthrow China in attracting venture

capital anytime soon. Investor interest in Southeast Asia and India is growing, but these

markets are less mature and investments tend to be smaller in size, according to VCs

and analysts.

From January to November, China recorded 2,972 venture capital funding deals

totalling $39.7 billion, down 26.9% in value from the same period in 2022. Startups in

India raised just $6.9 billion during the first 11 months of 2023, down 65.8% from

2022, according to research firm GlobalData.

One reason for China's relative resilience is the large amount of domestic capital

supporting VC investments, according to Angela Lai, Asia-Pacific head at Preqin.

"While India is growing, its VC market remains roughly a quarter the size of China's.

Not only does China have a large-scale private market, but the country also has a long

history of more than 20 years of venture capital, which means the country is much

further ahead of the game than newer players in terms of how infrastructure, talent, etc.

is set up in the regional venture ecosystem," she added.

Another factor that could keep investors cautious next year is the expectation that initial

public offering conditions will still remain tough, leaving mergers and acquisitions as

the most likely form of exit in 2024.

"Any rebound in IPOs won't be a significant one, nor do we expect many of the big-

name companies to pursue listings, at least not to the extent that the industry would be hopeful of," said Stanford at PitchBook.

A listing by Chinese fast fashion retailer Shein would be a shot in the arm for the IPO

market, though U.S. regulators are ramping up their scrutiny of the company and its peers.

"China and Hong Kong stock markets -- combined being the largest markets in Asia --

have underperformed in the past year, so this could imply ongoing challenges with the

exit environment there especially as the option of listing overseas [for Chinese

companies] has become limited," Stanford added.

Ramadurai at Harmonix said 2025 will be the year when the IPO market truly starts to

thaw.

"A lot of our growth-stage companies are pegging Q2 and Q3 of 2025 [as when they will]

start prepping IPOs," said Ramadurai.

Meanwhile, the excitement over artificial intelligence kicked off by OpenAI's ChatGPT,

which drove a flurry of investment this year, is expected to cool in 2024.

"Everybody jumped on the bus at the same time and hyper-saturated the market in 2023. And now a lot of investors have analysis paralysis where they can't even do a deal because they don't even know what's fact and what's fiction," Ramadurai said.